Introduction

Electronic Money Institutions (EMIs) are financial institutions that can open usual payment accounts, just like banks do. Individuals and companies can hold their funds there, make and receive payments. In Europe, the country with the largest number of licences is Lithuania. At the end of 2022 Q3, it had 82 full EMI licences and 5 restricted ones, bringing the total to 87.

Every quarter, the Bank of Lithuania publishes performance indicators of EMIs and Payment Institutions (PIs). It’s a great resource for reliable data. We also use their data in our tables, for example when comparing business accounts.

At the time of writing this blog post, the most recent data is for 2022 Q3. Let’s have a look at the top Electronic Money Institutions, ranked by how much customer funds they hold.

#1 for several years has been Revolut Payments – they are not an EMI any more in Lithuania (it was merged into a bank in summer 2022), hence everybody moved up the ranks.

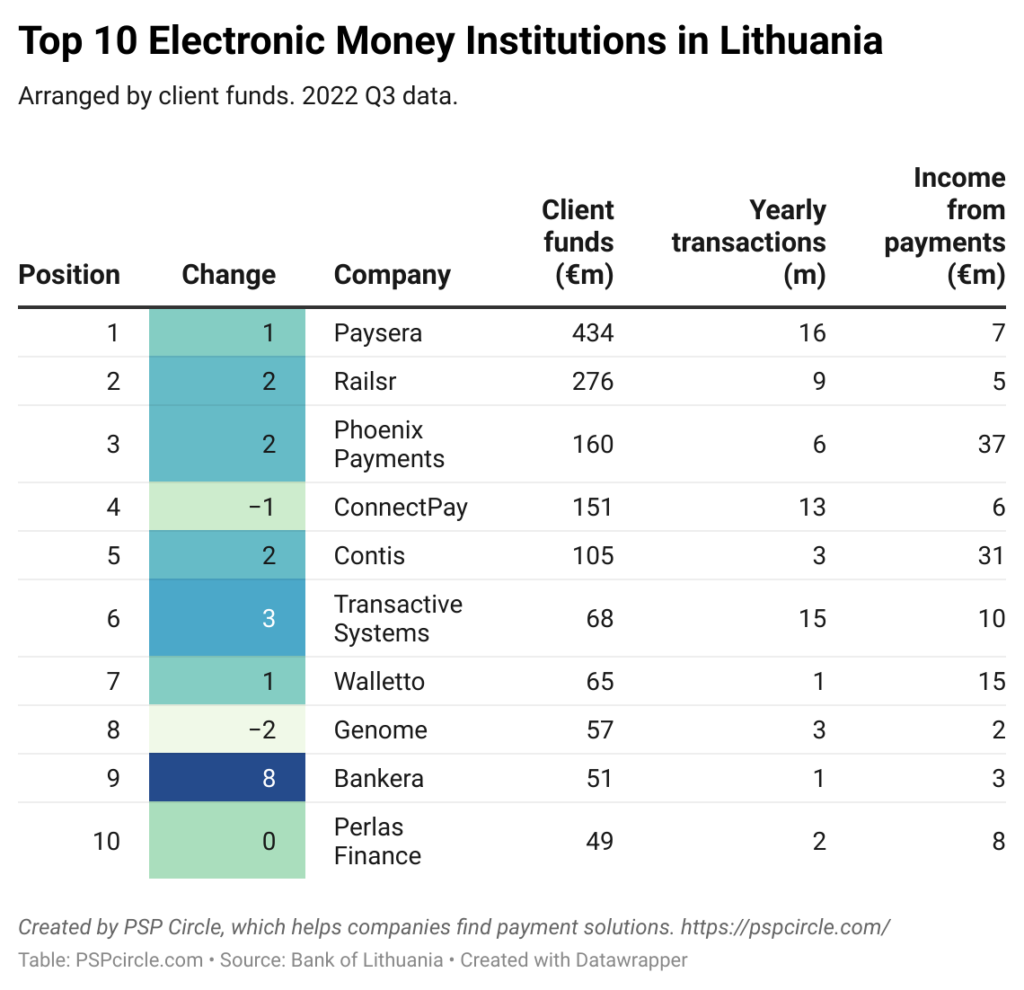

Top 10 Electronic Money Institutions in Lithuania (ranked by client funds):

Using the data from the Bank of Lithuania, we compiled it into a simple table, showing the company’s position at the end of 2022 Q3, change vs previous year, client funds (€m), yearly transactions (€m), and income from payments (€m). This is what the table looks like.

Let’s look at each company in more detail.

1. Paysera

Paysera (€434m). The OG of payment companies, established by Lithuanian founders, operating since 2004. Offers everything and to everybody. Paysera has two camps of customers – one that swears by them, the other side is more critical. They have low prices, poor reviews (2.7 out of 5 on Trustpilot), still growing at a fast pace. The company has other not common financial institution licences, leaning towards the South and East – Albania, Kosovo, Georgia. And they have their logo printed on a passenger boarding bridge at Vilnius airport. Beat that, other EMIs.

- Services: Accounts, cards, payment gateway, mobile payments at shops, ticketing system

- Customer types: Business and personal

- Founded: 2004

- Pricing: https://www.paysera.lt/v2/en-LT/fees

- Licences: Lithuania (EMI), Albania (EMI), Kosovo (EMI), Georgia (bank)

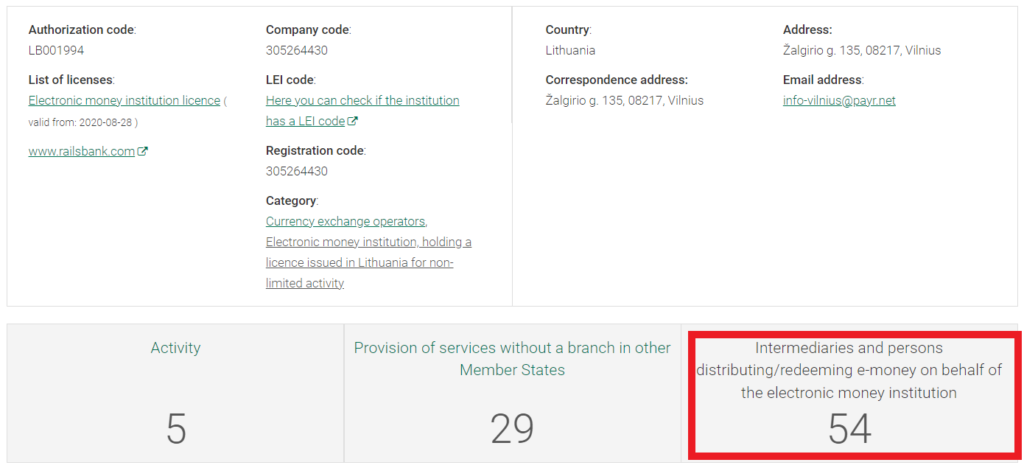

2. Railsr

Railsr (€276m). Their legal name is UAB Payrnet and formerly the company was known as Railsbank. Railsr is a British company and they established their Lithuanian EMI in 2020. They are not directly accepting clients but enable other companies to create their own payment platforms and issue cards. In other words, they are a Banking-as-a-Service (white-label payments) provider. Railsr has 54 agents registered under their name in Lithuania (that is a lot). There are quite loud talks about the company considering sale.

- Services: Banking-as-a-Service (accounts, cards)

- Customer types: Business

- Founded: 2016

- Pricing: Custom

- Licences: UK (EMI), Lithuania (EMI)

3. Phoenix Payments

Phoenix Payments (€160m). An Icelandic payments company, related to two other brands – Ibanera and E-comprocessing. Transaction features of Phoenix Payments itself now are quite limited according to the website – just euro payments (SEPA). They have the fewest employees of the top 10 companies – 16 at the time of writing. Their annual income from payment activities was just above €0.5 million a year ago. But now it’s €37 million. The highest among all EMIs licenced in Lithuania – a massive change.

- Services: Accounts

- Customer types: Business and personal

- Founded: 2018

- Pricing: https://phoenix-payments.com/

- Licences: Lithuania (EMI)

4. ConnectPay

ConnectPay (€151m). One of the better-known payment companies from Lithuania. They open business accounts to process SEPA & SWIFT payments, but also has other products – cards, a white-label payments platform, accepting card payments. They processed a massive number of transactions – over 13 million in a year. Their volumes are large too, at over €1 billion per month. Fun fact for rally lovers – in 2022, the company had their sponsored truck participate in the Dakar rally.

- Services: Accounts, cards, payment gateway, Banking-as-a-Service

- Customer types: Business and personal

- Founded: 2017

- Pricing: https://connectpay.com/pricing/

- Licences: Lithuania (EMI)

5. Contis

Contis (now Solaris Group): €105m. A British powerhouse in Banking-as-a-Service and card issuing, recently acquired by an even bigger powerhouse – Solarisbank group from Germany. They were processing €13 billion on behalf of 2.5 million end customers. Paysera actually uses Visa debit cards issued by Contis. Among their other clients were the largest crypto exchange Binance, and Bitpanda another large crypto exchange from Austria.

- Services: Banking-as-a-Service (accounts, cards)

- Customer types: Business

- Founded: 2008

- Pricing: Custom

- Licences: UK (EMI), Lithuania (EMI)

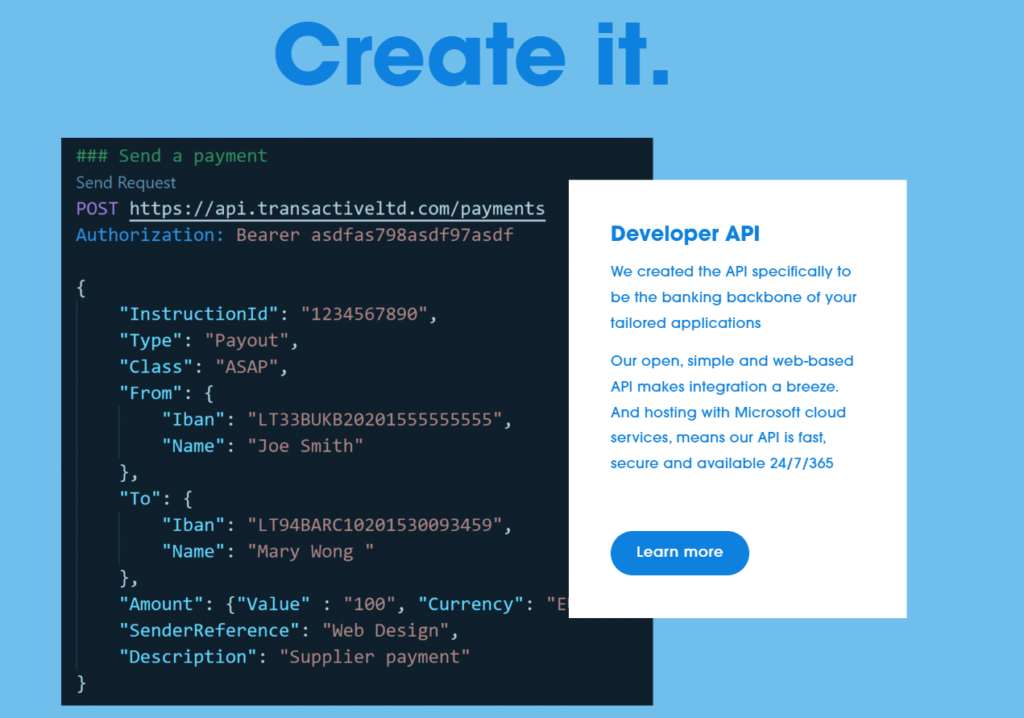

6. Transactive Systems

Transactive Systems (€68m). The Lithuanian payments company is a subsidiary of their UK company. Transactive Systems enables financial institutions and other companies to make payments in Europe and the UK via their technical integration (API). In only two years, they grew from under 1 million annual transactions to almost 15 million in the previous year.

- Services: Accounts

- Customer types: Business

- Founded: 2017

- Pricing: Custom

- Licences: UK (EMI), Lithuania (EMI)

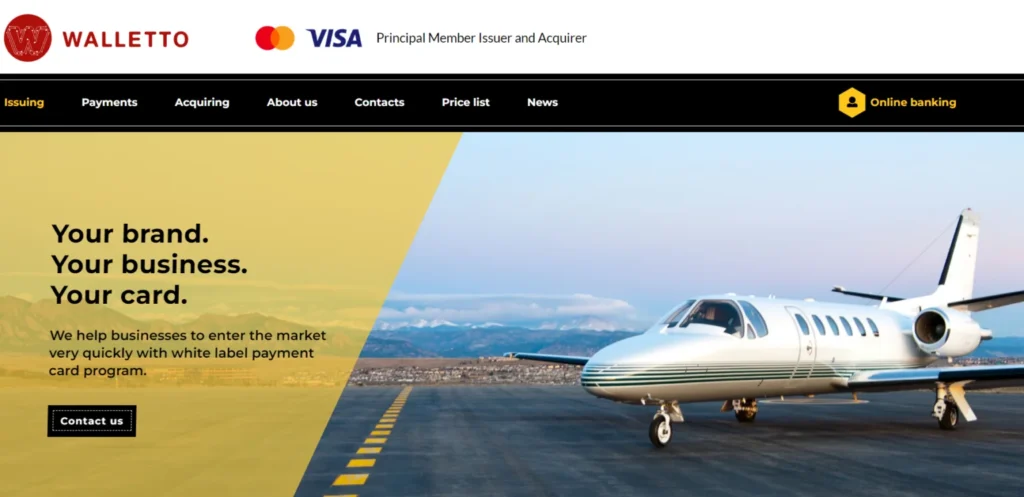

7. Walletto

Walletto (€65m). A Latvian-capital company that holds valuable assets – Visa and Mastercard licences for card issuing and acquiring (accepting card payments). That means they can do everything with two main card schemes – issue Visa and Mastercard cards for other companies, collect card payments. The company also has high income from payment services – €15 million.

- Services: Card issuing, card acquiring, accounts

- Customer types: Business and personal

- Founded: 2017

- Pricing: https://walletto.eu/price-list/

- Licences: Lithuania (EMI)

8. Genome

Genome (UAB Maneuver Lt): (€57m). A Ukrainian-capital company. The founder also runs a payment gateway Maxpay. They offer payment accounts, cards for their customers, accepting card payments. While their transaction numbers are increasing, client funds remained almost unchanged in 2 years, and decreased since last year.

- Services: Accounts, cards, payment gateway

- Customer types: Business and personal

- Founded: 2018

- Pricing: https://genome.eu/low-risk-business-account-pricing/

- Licences: Lithuania (EMI)

9. Bankera

Bankera (UAB Pervesk): €51m. A company that focuses on payment accounts (business and individual) but also has a range of other services – card issuing (Visa licence), white-label payments, payment gateway, loans. The company’s founders also founded a cryptocurrency exchange SpectroCoin. Bankera made the biggest leap among the top 10 EMIs (+8 spots in a year). Really nice to see this, as I was still with the company then, running the sales team.

- Services: Accounts, cards (and card issuing), payment gateway, Banking-as-a-Service, loans

- Customer types: Business and personal

- Founded: 2017 (Pervesk)

- Pricing: https://bankera.com/pricing/business-account/

- Licences: Lithuania (EMI)

10. Perlas Finance

Perlas Finance (€49m), part of the larger Perlas group. They have everything from terminals for cash operations, to payment accounts, to a bill consolidation app. Perlas terminal is a local legendary solution in Lithuania known for having physical machines in every store of every village and every city. It’s a baby of a love square between an old computer + a cash register + a printer + a barcode scanner. These machines act as local ATMs, a spot to pay bills, transfer money, buy and check lottery tickets, and other services. Another great advantage is that it gives you a plan B if you are planning to physically rob your local village store and the standard cash register doesn’t work out.

- Services: Payment collection, cash operations, account top-ups (mobile), other

- Customer types: Business and private

- Founded: terminals – 1995, Perlas Finance – 2008

- Pricing: PDF

- Licences: Lithuania (EMI)

Summary

So here are the top 10 Lithuanian EMIs. Their main services offered are – payment accounts (mostly business accounts, sometimes individual), Banking-as-a-Service, card issuing, accepting card payments (via their payment gateway). You can find more of these service providers here: https://pspcircle.com/providers/.

Have questions or need advice about payments?

We help clients open business accounts for their online companies, find acquiring solutions, implement open banking payments, optimize FX & international money transfers, issue cards, launch Banking-as-a-Service payments, find the right core banking software provider. Want to discuss your payments case? Contact us via the website or write to us at [email protected].

Like our content?

I really appreciate you reading this far. PSP Circle is a young business and each reader is very valuable to us. If you like our content, here is what you can do:

- Have a website? Link to the article that you like

- Share our posts on LinkedIn or other social media (click one of the icons above the article)

- Follow PSP Circle and me (Justinas Badaras) on LinkedIn

- Subscribe to our newsletter using the form below