With so many banks and payments providers to choose from, it can be difficult to choose where to open a bank account for your business in Europe. In this article, we’ll take a look at the key things to consider when selecting a payments provider for your business bank account in Europe. Let’s dive in.

Key factors to consider when opening a business bank account

1. Your business

At first, have a look at your company – specifically, your industry and registration country. It will largely determine your company’s risk. If you are a local bookshop, an e-commerce store, or another low-risk local business, an account with your local bank may be enough. On the other hand, if your business is operating in a higher risk industry or is registered in a different country, you will likely have to look for alternative solutions – mainly, Electronic Money Institutions (EMIs). The reason for that is that banks may not work with high-risk companies and companies that are registered in a different jurisdiction.

2. Bank vs EMI

You will have two main options with what type of financial institution to open an account in Europe – a bank and an Electronic Money Institution (EMIs). Let’s look at what clients they work with and the safety of each option.

Option 1: Bank

The traditional option. Mostly suitable to domestic businesses, low-risk businesses or large businesses. In the euro area, all deposits below €100 000 are insured in case the bank becomes insolvent. However, businesses often hold larger amounts which would be at risk in case of insolvency. Also, banks operate on a fractional reserve model, where only a small part of your deposit is held untouched. The largest part of these funds are lent out.

Option 2: EMI

The type of licence that is still quite new and less familiar to the public. EMIs started appearing in the 2010s after the implementation of PSD1 (Payment Services Directive) and later PSD2. EMIs can issue you the same IBAN as a bank. They are usually more flexible with what kinds of clients they work with. So for high-risk and international clients, this is a common go-to option.

The safety requirements are actually higher than those of banks. EMIs may seem more risky with their colourful websites, but in fact the regulation of their client funds is very strict. EMIs have to safeguard 100% of client funds by keeping them in a separated account with a European bank (commercial or central), invested in low-risk bonds or insured. For example, the Bank of Lithuania publishes statistics every quarter where Lithuanian EMIs safeguard funds. In 2022, two thirds of safeguarded funds were held with the central bank itself, a very safe option. The main risk of holding funds with an EMI is that the EMI itself goes out of business because their operations are restricted by the regulator, and you will have to look for a new provider.

What is also important is the jurisdiction of the bank or the EMI. Unless, it’s some more unusual requirement, stick to European/UK EMIs and banks.

3. Reputation

The category that is not easily measurable but is very important when choosing a safe provider. Here are some good sources:

- Sanctions imposed on the company by the regulator. Not just sanctions like fines, but also warnings, activity restrictions and other negative information. If your potential payment provider has a poor track with the regulator, not good. Regulators publish lists with licensed market participants in their country – the most reliable information about sanctions can be found here. For example, this is the link for Lithuanian EMIs.

- Team. Look at their team on LinkedIn and on their website, if available. Key managers missing on LinkedIn, shady profiles, lack of experience, team outside of Europe, other weird things – these are common proxies for a red flag.

- Years in operation. The longer, the better. EMIs are a new form of a financial institution, so they won’t have long histories, but 6 years is better than 2 years. They had more time to fine-tune their operations and compliance, and likely had an inspection by the regulator.

- Feedback from your partners. Useful if you know somebody using the company’s services. One way to know what bank your business partners are using is by checking their payment details, specifically BIC/SWIFT number. It will show you what bank/EMI the company is using.

- TrustPilot. The go-to review website for many products. Take this with a grain of salt because some financial institutions don’t have many reviews. Or vice versa, a very large number of reviews, which are left by individual clients (not businesses) and will not be very relevant to you.

- Google. A simple Google search with the company’s name + a term such as “fraud”, “scam”, “frozen” , “fine”, “sanctions” and similar can reveal what the first Google pages will not show.

- PayRate42. This niche website is assigns ratings (Green – Orange – Red – Black) to Payment Service Providers (PSPs), depending on their perceived risk and compliance. Their job is difficult – to judge a company from the outside, hence the reliability is never going to be precise, however, it may show you some red flags about the company and its owners.

4. Risk appetite

Before applying, make sure the financial institution is ok with your type of business. Don’t lose time and money. Have a free consultation with us. We are in close contact with decision makers in many financial institutions and will discuss your case, which would result in a quick preliminary decision.

5. Fees

Comparing the fees between different business account providers is a natural first step. Make sure you understand all the fees associated with the account. Here is the breakdown of the most important fees:

- Account opening vs Application review fee. They seem similar but there is a big difference between the two. Understand it carefully. The account opening fee is paid after the IBAN is issued. So you won’t pay if your application was rejected or you didn’t finalize the onboarding process. Conversely, the application review fee (can be named differently, e.g. compliance fee) is paid upfront to start the application.

- SEPA (euro) transfer fees. These are your usual online payments in euro. SEPA stands for Single Euro Payments Area. It’s a payment integration initiative launched by the European Union to simplify and standardize bank transfers denominated in euros within Europe (plus a few other countries and regions). SEPA transfer fees may be fixed (typically, for low-risk businesses), a % of the payment amount (more often for high-risk businesses), or fall somewhere in between.

- SWIFT/international payment fees. Like SEPA for euros, SWIFT is a standard for international payments in multiple currencies. These payments are slower and usually more expensive than SEPA payments. They can also be fixed, a percentage, or a combination of the two.

- FX markup. Also related to international payments. It is a hidden fee. You can use our exchange rate markup calculator to calculate the margin your payment account provider charges.

- Monthly fee. A fixed fee for your account’s maintenance. Increases with the risk of your business.

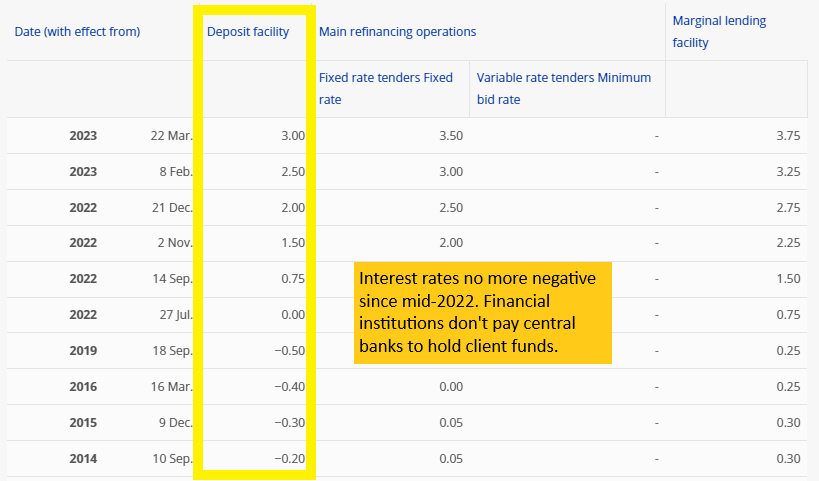

- Balance fee. Has alternative names, such as administration fee. A leftover from the time when the interest rates were negative. You can check ECB interest rates here (see the ‘Deposit facility’ column). It was costing to keep (‘safeguard’) client funds with a credit institution, such as a central bank. Because the interest rates are no longer negative, the balance fee now should be 0 – otherwise, it’s a hidden fee by your payment provider.

- Other fees. Inactivity, closing the account, bank letter, payment cancellation, etc.

6. Account type

There are many account types – capital deposit, correspondent, savings, trust, escrow, and others. However, the two main account types for businesses are:

- Operating account. This is the most common type of bank accounts for businesses. They are used for daily transactions such as paying bills, receiving payments from customers, and transferring funds between accounts.

- Client funds account. These accounts are used by businesses that handle funds on behalf of clients or customers, such as gambling operators or crypto exchanges. Client funds accounts are typically subject to strict regulations and may require additional reporting and oversight. Make sure to confirm that your payment provider will be able to support customer deposits and withdrawals (C2B and B2C payments) for your desired currencies.

In many cases, your company will need two accounts – one for its own expenses (rent, salaries, pay suppliers) and the second one to keep client funds segregated.

7. Compliance of the EMI/bank

Compliance. The unfortunate department that doesn’t get much love from the clients. The two main things business clients encounter (a nicer word than “argue”) with compliance teams are the onboarding process and when there are questions related to transactions, arising from transaction monitoring.

Luckily for compliance teams, businesses slowly learned to understand that fast onboarding with few questions is not necessarily a good thing. It may lead to something equivalent to the “Titanic”, just in payments. The protagonist (EMI) is crying and waving goodbye to the licence, to the soundtrack of “My Heart Will Go On” by Celine Dion.

That said, there is also a limit where a business will give up and choose a different provider. It’s difficult to say, but high-risk businesses should be onboarded within 1-2 months max if all answers and documents are provided. Low risk businesses should be much faster.

Similarly, your payments provider will want to know what payments will be processed through your account. When making or receiving a payment, they may ask for the explanation, proof (invoice, contract) and related information. It’s not easy to understand if what they request is excessive. If you have other accounts, the easiest way is to compare it with the alternative. Also, common sense should apply – for example, if they are asking for the same agreement for the n-th time, it is not a good sign.

Compliance is there to ensure the longevity of business. Don’t see compliance as the bad guys!

8. Currencies

Consider whether the provider offers the ability to hold and transact in multiple currencies. This can be important if you plan to do business in multiple countries. In our list of business account providers, we have a column with the number of currencies. It’s a good first step for comparison but the company’s website will give you the most recent data.

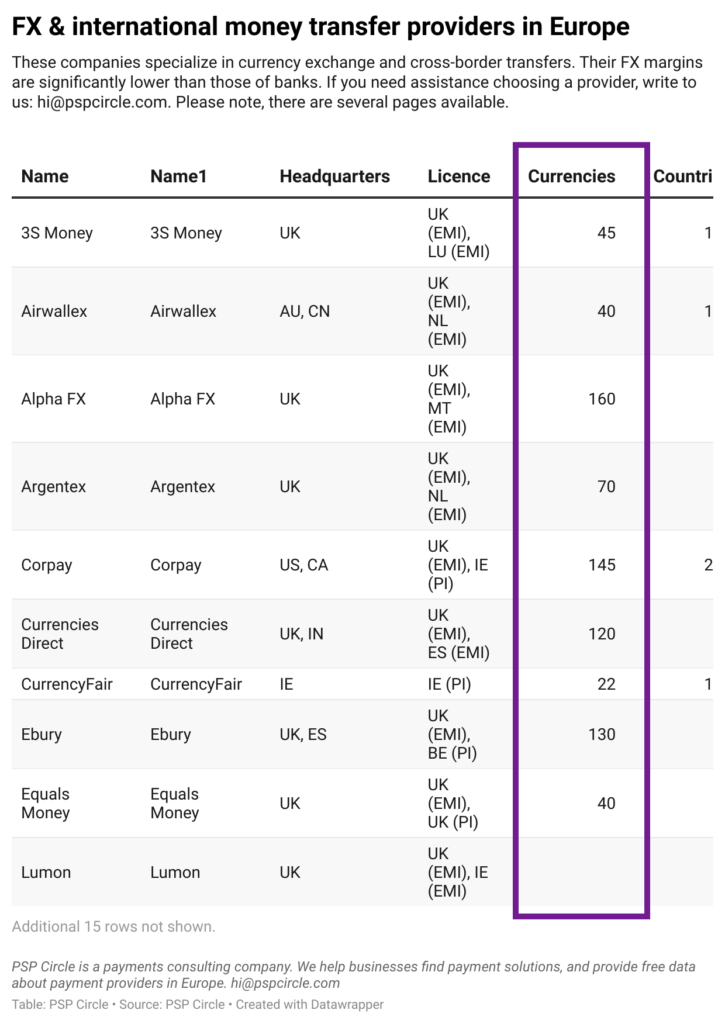

Normally, banks (and most EMIs) have fewer currencies and higher exchange rates than international money transfer providers. So if your business is exchanging a lot of currencies, consider opening an account with an international money transfer provider. You can see that the number of currencies in their offering is massive.

9. International payments

Aside from currencies, you must be sure that you will be able to make and receive payments to/from your business partners. For that, you will have to check if your financial institution is able to process payments to the country where your partner’s business is registered and where its bank is licenced.

Another factor to look at within international payments is whether the financial institution offers a ‘pooled account’ vs an account in your name.

Some smaller financial institutions hold an account with a larger payment provider in their own name – a ‘pooled account’. So when your clients make a payment to you, the recipient can be the financial institution and your name would only be in the reference. Similarly, when the payment is made from you to the receiver, the sender would be seen as the financial institution. This may raise some questions and inconveniences.

An account in your name, either via direct SWIFT integration or virtual IBAN (vIBAN) is usually preferred. This way the recipient and the sender will be your company.

It would look something like this.

Pooled account

- Beneficiary: Gotham Bank Limited (your bank’s name)

- IBAN: DE64500105174348795969 (your bank’s IBAN, not unique to you)

- Reference: ABC1234 Your company’s name (payment to you is tracked by this reference)

An account in your name

- Beneficiary: Your Company Limited (your company’s name)

- IBAN: DE23500105177745726425 (named IBAN, unique to you)

- Reference: INV120315 (Invoice number)

10. SEPA Instant

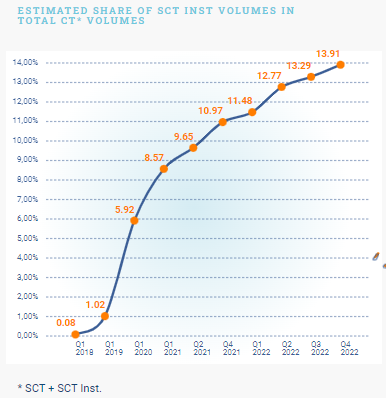

SEPA Instant Credit Transfer allows real time payments to be made 24/7, including weekends or holidays. This applies to payments under €100 000. Over 71% of Payment Service Providers (PSPs) in the euro area have already joined the scheme but the share of instant transfers was still quite low at 13.91% in Q4 2022. You can check if your financial institution is part of the SEPA Instant scheme in the European Payments Council register.

11. Multi-user access

In a standard case, the person having the access to the company’s account is the director. But in many other cases, other people (e.g., accountant, CFO) may want to make payments or sometimes have the oversight of the account without the right to make payments. Each user should be able to have their own limits, and the payment provider should provide custom approval rules. For example, when the director has to approve each payment above €25 000.

12. API integration

You may want to integrate the API of the payments provider, for example, to initiate payments or to receive notifications when a payment is credited to your account. API integration is more relevant to platforms, where platform’s clients request to make a withdrawal. Then this request is pushed via the API to the payment provider and the payment is initiated. This helps avoid manual work and makes payments faster.

Also, some businesses may want to integrate with their accounting or payroll platforms, however, this is not a very common request among small and medium businesses in Europe.

13. Mass payments

Alternatively known as mass payouts, batch payments or bulk payments. Mass payments are relevant to you if you are doing a high number of payments daily. A file with details about multiple payments is uploaded (usually, in CSV or XML) to the payment provider’s platform. Then these payments are initiated and processed automatically, instead of having to make payments one by one.

14. Size of the company

A subjective factor but I personally prefer working with EMIs that are not very small. At least 20 people and at least €15-20 million of client funds held. Smaller EMIs may be perfectly fine but also may indicate some potential issues. The most worrisome is the lack of Anti Money Laundering (AML) personnel.

While the number of employees is easy to see (website, LinkedIn) the amount of client funds is not. Luckily, the Bank of Lithuania publishes how much funds Lithuania EMIs are holding. Since many payment providers are registered in Lithuania, this is quite helpful. We also publish this data in our list of business account providers.

15. Support

The level of support you will get from the company’s support or account management is very important. If you have questions or request, then template answers and slow responses will most likely lead you to losing the nerve and changing the account provider. A good account manager is ideal. Your account manager should be able to convey your information to the company, acting as an intermediary between you and the company.

EMIs often have much better service for small and medium business clients because banks are just too big to handle custom requests from many clients.

16. User experience (UX)

Let’s look at some of the most important factors adding up to your user experience:

- Security. Top priority that may deserve a separate section but is also a good fit with the other factors here. First and foremost, the financial institution should have strong security measures to protect your account from unauthorized access. But security also covers a wider range of methods – from a selection of two-factor authentication (2FA) methods to secure communication via internet banking, to fraud monitoring.

- Speed in processing transactions. If the company requests additional informational about your payments, do they handle it fast and professionally? Nothing is more annoying than an urgent transaction being held up, and you receive no updates about it.

- Communication. Is the company communicating nicely (e.g., “Hi Matilda” instead of “Dear Sir/Madam”) and clearly? Are you feeling heard when you have enquiries? Do you get template answers or straight to the point answers?

- Language support. While many clients speak English, local language support is always a nice touch. Especially, if documents and requested info can be provided in local language, without having to obtain a copy translated to English.

- Design. The design of the platform helps when it is visually appealing, with a clean and modern interface.

- Functionality. Can you get a bank statement? Can you request to increase account limits, order a card or add another user via the internet banking platform? Can you save payment templates?

- Accessibility. Online banking platforms should be able to accommodate individuals with visual, auditory, or mobility impairments. Accessibility also benefits other groups, such as the elderly or people with limited access to technology (e.g. they can’t do 2FA via an app because their phone doesn’t support it).

- Navigation. The platform should be easy to navigate, with intuitive menus and clear labelling. Users should be able to find what they need quickly and easily, without having to search through multiple pages. Communication history with the company should be accessible and easily searchable.

- Mobile optimization and/or app. Slightly less important for business banking but there are times when you will want to make a transfer or check the account while away from the desktop.

17. High-risk client? Have at least 2 accounts

If you are a high-risk client, always have at least two accounts opened, preferably in different jurisdictions. In case one account gets closed (either because of you or because of the provider), you will be able to use another account at least temporarily. There were many bad examples that happened when Wirecard shut down and companies only had 1 account with them, leaving them desperate to open a new one.

18. Additional services

If you require additional payment services (e.g., cards, open banking payments, acquiring or similar) it is often a good idea to have more services provided by one provider. The reason for that is economical and that you only have to deal with one entity when answering their requests.

Unsure which account to choose? We can help you

PSP Circle has extensive experience and network, allowing us to help you find the most suitable business bank account provider for your case. We always listen to your requirements and provide alternatives based on them. Contact us and get the options available for you. This is completely free.

Like our content?

Thanks for reading this far! PSP Circle is a young business and each reader is very valuable to us. If you like our content, put a link on your website or share it on social media (click one of the icons above the article). Also, follow PSP Circle and me (Justinas Badaras) on LinkedIn.

A lot of information? We made a cheat sheet for you with all the important factors in one place

PSPcircle.com